LunaProxy vs PyProxy: Features, Pricing, Performance, and Use Cases in 2025

Compare LunaProxy and PyProxy in this 2025 proxy showdown. Explore features, pricing, performance, and use cases.

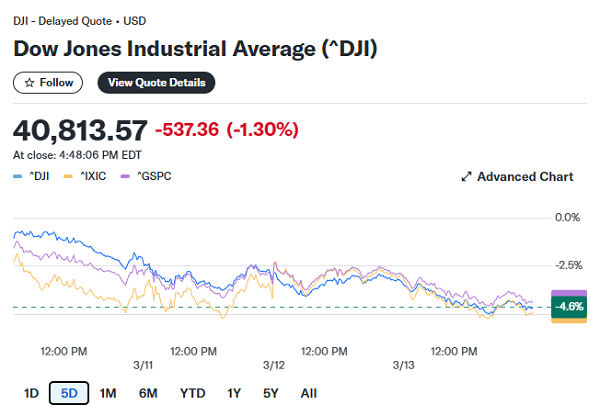

The Dow fell 500 points on March 14, 2025, as concerns over U.S. tariff threats led to market volatility, affecting tech stocks and pushing the S&P 500 into correction territory.

Within the last 24 hours, global financial markets have been volatile due to concerns over U.S. economic policies, particularly President Trump's tariff threats. On March 14, 2025, the Dow sank 500 points. The decline reflects investors' concerns about their potential impact.

Picture from Yahoo Finance

Global financiamce rocked on March 14, 2025, as the Dow Jones Industrial Average suffered a steep 500-point decline. Investors are much worried by economic policy uncertainty, with particular concerns over new trade tariffs and their potential impact on key industries.

Reports from Yahoo Finance and Reuters indicate that the S&P 500 entered correction territory, signaling a broader downturn across major stock indices. The technology and internet sectors bore the brunt of the decline, reflecting market fears about the rising costs of global trade disruptions.

Investors' confidence was severely hit, and fears over trade restrictions and their economic consequences. The uncertainty surrounding potential tariff implementations has left traders in heightened caution, leading to heavy selling across industries.

Key Factors Driving the Market Downturn

Investors are concerned about the possible new trade tariffs, which raise costs for supply chains and multinational corporations. Also, economic policy ambiguity increased market volatility. Major Indices' descent into correction territory signals a broader market downturn, increasing fears of prolonged instability.

Investor Reaction & Market Response

As the above concerns, financial experts are closely monitoring potential countermeasures from key trading partners. As global trade restrictions are likely to increase, investors need to reassess their portfolios in response to the shifting economic landscape.

During the stock sell-off, technology and internet-related companies were among the hardest-hit industries. They rely heavily on global supply chains and international markets and, thus, are significantly affected by trade disruptions and increasing tariff-related costs.

Key Reasons for the Tech Sector’s Decline:

Tech firms often source components internationally, so their operational costs will be higher due to tariff-induced price hikes. Restrictions on semiconductor imports, cloud infrastructure equipment, and IT services hurt the supply chain, driving costs even higher. Plus, the market downturn has prompted risk-averse behavior, and investors choose to pull back growth tech stocks.

How This Impacts Tech Companies & Investors

As a short-term impact, increased volatility and speculative trading as investors react to policy updates. As long-term concerns, if tariffs are implemented, profit margins for major tech firms could shrink, impacting their growth projections. Some institutional investors may adjust their investment strategy from funds to defensive assets, anticipating further instability.

How Prolonged Trade Policy Uncertainty Affects Global Markets

Beyond the technology sector, analysts caution that persistent trade policy uncertainties could prolong market volatility across various industries, including:

What Investors Are Watching Next

The Fed’s stance on interest rates and economic stimulus will be a key factor in shaping market movements. Whether tariff threats will materialize or be resolved through diplomacy. Besides, the next financial quarter’s earnings data from key sectors may provide insight into how companies are adapting to economic pressures.

The ongoing economic instability could have ripple effects on businesses operating in the proxy and tech infrastructure industries, including

Increased Costs: If tariffs impact hardware imports, server infrastructure expenses could rise.

Regulatory Concerns: Companies dependent on international traffic or data routing could face new compliance challenges.

Market Demand Shifts: As businesses look for cost-effective solutions, demand for alternative tech services such as cloud-based proxies may increase.

For proxy industry investors, please stay informed about new trade policies that could affect operational expenses. Exploring alternative suppliers or data centers in low-tariff regions may help mitigate cost increases. Investing in privacy-focused proxy solutions may remain a growth opportunity despite economic turbulence.

To navigate market volatility, consider:

For businesses to prepare for economic shifts, consider:

As the global economy faces heightened uncertainty, investors and businesses are remaining vigilant in tracking policy decisions, economic indicators, and market sentiment. The coming weeks will be critical in determining whether the market downturn is a temporary correction or the beginning of a longer-term trend.

While tariff threats and economic policy concerns continue to shape financial markets, businesses that adapt quickly, leverage technology effectively, and navigate risks strategically will be better positioned for success.

For investors, staying informed, diversifying risk, and maintaining a long-term perspective are key principles in navigating this period of financial turbulence.

< Previous

Next >

Cancel anytime

Cancel anytime No credit card required

No credit card required